There are a lot of people in the cryptocurrency industry who can explain Bitcoin better than I can, so I will synthesize their explanations, writings, videos, and graphs below in an easy to understand format and add hyperlinks to help give you a basic understanding of Bitcoin. Feel free to use the information below to dive in as deep or little as you want into Bitcoin. Let’s start with the easiest explanation and continue down the rabbit hole.

What is Bitcoin?

Cryptocurrency is a form of digital payment online for exchange of goods and services. Bitcoin is a one type of cryptocurrency. This peer-to-peer electronic cash system is decentralized digital money using blockchain technology. Bitcoin replaces the bank as the third party in a transaction and replaces it with an anonymous verifier to complete the transaction over the internet. Instead of taking days to complete a transaction with a traditional bank, Bitcoin transactions are verified within minutes. The two people making the transaction can live in different countries and can transfer any amount of this cryptocurrency within a matter of minutes using an internet connection with no exchange rate and banks not taking fees. For example, Person A sends their Bitcoin using an exchange from their wallet to person B’s wallet with a unique address. Bitcoin is not the first cryptocurrency and has used the failures and successes of past cryptocurrencies and probability theory to create Bitcoin.

Who Created Bitcoin?

Satoshi Nakamoto created Bitcoin with it launching on January 3, 2009. The public is unsure if Nakamoto was a single individual, pseudonym, or a group of people who created this cryptocurrency. Nakamoto built Bitcoin with other well established software programs, such as cryptographic, to build Bitcoin. Nakamoto is listed as the sole author who wrote the Bitcoin white paper explaining in an advanced way what is Bitcoin, how it works, and its security and philosophy. Satoshi Nakamoto White Paper

What is Blockchain?

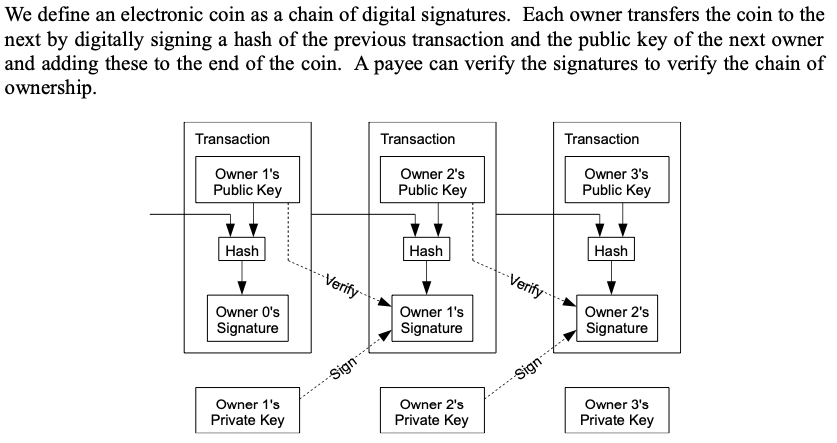

A block is a digital ledger of a transaction and a record of a digital cryptographic known as a hash. A block holds transactions. One block contains around 500 transactions. Multiple blocks joined together are called a blockchain. Bitcoin uses an open source software and you can view all the past transactions from its inception, much like a paper check ledger from people running nodes. These blockchains are secured by what is called cryptography. Each block has a signature with a private key and is verified by using its public key. If any data is changed in the block, the block becomes invalid and will not make it into the chain.

This is a screen capture from Satoshi Nakamoto’s white paper explaining the transaction process of Bitcoin

For example, a paper check ledger is a small book where you record the amount you are taking out of your bank account, the total amount in your bank, where the money is being moved, the check number, and date. The actual check note has the date, amount of money, who the transaction is going to, who the transaction is coming from, what bank you are using for the transaction, routing number to your account, the bank routing number, the memo, and signature. Bitcoin works in a similar way, it is a digital transaction with the miner (third party) being anonymous to verify the transaction.

The scalability of Bitcoin transactions on its blockchain is limited. This is solved by off-chain transactions beside the main Bitcoin blockchain by the lightning network. To understand the, Bitcoin Lightning Network: Scalable Off-Chain Instant Payments, you need to read the Lightning Network Paper.

What is Bitcoin Mining?

In the simplest terms, Bitcoin miners are auditors who are verifying the Proof-of-Work in a block and are rewarded in Bitcoin. Miners can only verify 1 megabyte at a time and may not get rewarded unless they are the first person to solve the problem. Bitcoin mining is correlated with a transaction, timestamp server, proof-of-work, network, incentive, reclaiming disk space, verification, combining & splitting value, and privacy. More Information

There are a limited amount of Bitcoins that can be digitally mined in the world which equates to a total of 21,000,000 Bitcoin. Over 18,000,000 Bitcoins have been mined and are in existence with 900 bitcoins being mined daily (144 blocks are mined daily and there are 6.25 bitcoins in one block). The amount of Bitcoin you can mine in one block is halved every four years. For example, on May 11, 2020 when block 630,000 was mined it halved from 12.5 to 6.25 bitcoin. The next halving will be in 2024 and the mining rate will halve from 6.25 to 3.12 and so on and so on. This halving will continue to happen every four years until all the Bitcoins are mined which will happen in the year of 2140.

Each Bitcoin contains 100 million Satoshi. One Satoshi, named after the creator, is equal to 0.00000001 and one Bitcoin looks like this: 1.00000000. For example, in the year 2041 the mining reward will be .19531250 Satoshi. Continued halving will make Bitcoin more scarce with the reward becoming less as time moves forward.

What is the intrinsic value of Bitcoin?

As more and more people buy Bitcoin the social construct of this cryptocurrency rises. People holding Bitcoin as a continued growing society are giving it value just like a regular fiat currency not backed by anything except the government of that specific fiat itself. More Information

The market capital of Bitcoin is almost 1,000,000,000,000 dollars and continues to fluctuate, but grows annually (the market capital of gold is 10,000,000,000,000 to give you a comparison). Bitcoin’s intrinsic value has slowly been rising due to being divisible, durable, recognizable, portable, and scarce. Bitcoin has become socially adopted by people and companies around the world since 2009, but the greatest adoption by businesses started within the 2020-2021 time frame. Two of these public traded companies include MircroStrategy and Tesla while the list of companies continues to grow.

How Secure is Bitcoin?

There is no central authority over Bitcoin making it decentralized across the world. No one person controls the Bitcoin protocol. Bitcoin software and its blockchain is open source, meaning anyone can view the ledger of all Bitcoin transactions and these transactions are irreversible solving the double spend issue. In order to change the Bitcoin protocol a person needs to first submit a Bitcoin Improvement Proposal. Then it must be approved by an editor and finally voted on with 95% confidence from miners. After this vote the Bitcoin community upgrades to the newest version of Bitcoin software. More Information

A node is a server or or storage device that holds the entire bitcoin blockchain. The miners and nodes work together to verify all transactions. These nodes run Bitcoin software that enforces Bitcoin rules/protocol. The Blockchain cannot be tampered with, as any change to the transaction data changes the unique hash and exposes the cheating node. No transactions can be deleted as each is linked to the preceding one and any disruption is easily detectable. More Information

Bitcoin is actually protected by the United States First Amendment during a court case against Phil Zimmerman and his Pretty Good Privacy email software. This cryptographic software was originally used as a humans right tool and was published online for free in 1991. He then became the target of a three year criminal investigation by the United States government for exporting cryptographic software outside the United States. In order to ban Bitcoin in the United States the government would have to take away the First Amendment. More Information

The only way to shut down bitcoin is to turn off the internet world wide and keep it off indefinitely from any nodes. Not one industry would want to turn off the internet because of how integrated businesses are to the internet and the costly interruptions it would cause to their own businesses.

How is Bitcoin Taxed in the United States?

The United States taxes Bitcoin as property and you only pay capital gains in the United States when you sell, switch it to another cryptocurrency, or trade your Bitcoin to someone other than yourself. If you move your Bitcoin from your own wallet to another wallet you own, you are not taxed.

For this reason, it is not prudent to constantly sell or use any type of cryptocurrency as a daily currency because the short term and long term capital gain tax rate is currently above 15%. However, using Bitcoin as a store of value over a lifetime and taking out loans against Bitcoin are more economical since you will not be taxed on the loan. For more information on loans see BlockFi below. More Information on U.S. Taxes

More Information

If you would like to learn more about Bitcoin please click on the links below.

Plan B Model: Bitcoin Stock-to-Flow Asset Model

The Investor Podcast: Bitcoin Fundamentals

Lyn Alden: 7 Misconception About Bitcoin

Taking a Loan, Lending Bitcoin and Earning Interest: BlockFi

Book: The Bitcoin Standard by Saifedean Ammous